Affordability versus Risk

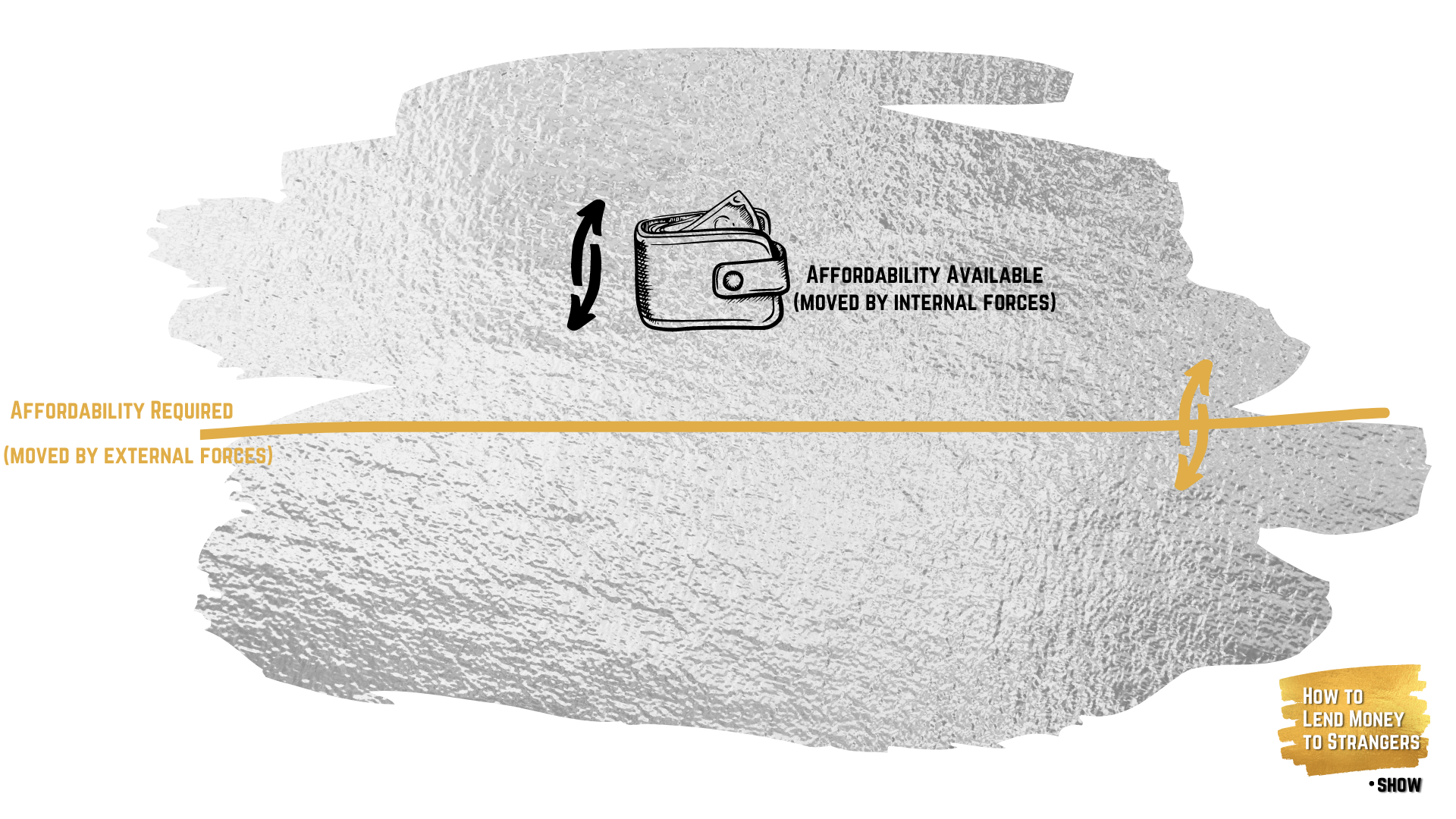

A good credit history and money management skills speak to a consumer’s willingness to repay, affordability checks speak to their ability to repay. And, at least in theory, calculating a consumer’s ability to repay a loan should be the simpler of the two tasks, being that ‘ability’ is all about the numbers while ‘willingness’ requires us to get inside the borrower’s head to some extent. Of course, it is not so easy in the real world, but simply put, a consumer is able to repay a loan when they have more money available to meet their debt obligations than they need to keep those obligations up-to-date.

What does a lender look like… on the inside?

In theory, the mechanics of consumer credit are simple: you borrow a large sum of money at a low-interest rate, break it into smaller parcels, and then lend those out with interest rates set high enough to allow the gains made on the repaid loans to cover the losses you made on defaulted ones, plus the admin costs involved in keeping it all together.

In practice, of course, that is easier said than done.

The very basics of scorecards

That’s the ‘when’ answer to the future question. To answer the ‘what’ question, we need a ‘bad definition’. We talk about ‘bad’ because in lending risk it is usually based on a level of delinquency (often whether an account goes more than 90 days past due) but it is really a definition of the activity we’re trying to predict. There are even occasions where we might actually be looking for a positive outcome: for example, in a late-stage collections score we may target consumers who actually make a payment.

In all cases, we want to pick an outcome that is sufficiently common to create a workable population but also stable enough to minimise noise. So even though an ever 30+ bad definition would capture more bads, many consumers who miss one payment might do so for administrative reasons or might otherwise be able to cure so mixing them into the population would only dirty the waters. At least that’s the case for something like a credit card. In a product like a bank overdraft, where consumers who miss one payment invariably miss more, and where missed payments are less common overall, an ever 30+ bad definition might be perfect.